We regularly update our articles to include the latest research, expand coverage, and add new information as it becomes available.

January 31, 2024 Our Editorial ProcessOur editorial process includes extensive measures to verify accuracy, provide clarity on complex topics, and present factual information. Read more

Table of ContentsIf your doctor has prescribed continuous positive airway pressure (CPAP) therapy for the treatment of your sleep apnea, equipment costs can seem overwhelming. However, private insurance plans and Medicare may help cover some of the costs of CPAP treatment including some CPAP supplies.

If you are starting CPAP therapy or considering new equipment, it can be helpful to understand the costs of CPAP. Knowing more about insurance coverage for CPAP machines, as well as the out-of-pocket cost of CPAP therapy, can help you plan financially for your sleep apnea treatment.

CPAP machines are often at least partially covered by private insurance, as well as by government plans such as Medicare. In fact, from 2014 to 2017, insurance claims featuring an obstructive sleep apnea diagnosis increased by 850%.

CPAP machines are covered as durable medical equipment (DME). Durable medical equipment is equipment that someone can use once or on a daily basis for a health condition or injury. The coverage may extend to CPAP supplies such as the hose and mask.

When a person has private insurance, their insurance provider will work with a company that sells and distributes medical devices. The medical device company will then provide the person with the CPAP machine, as well as necessary equipment such as the CPAP mask and tube.

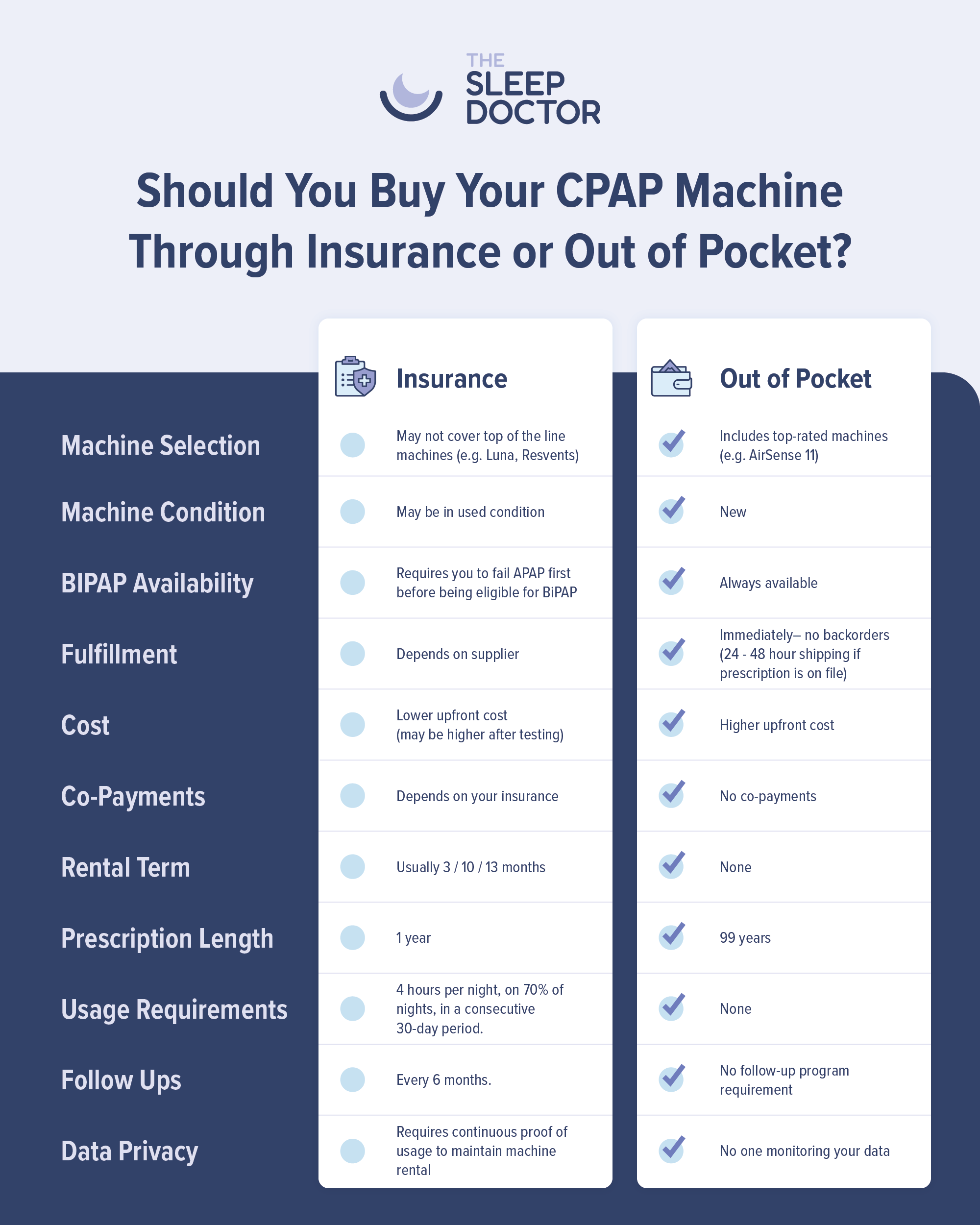

People with insurance coverage usually need to pay some amount out of their own pockets and demonstrate that they are using the CPAP correctly. The costs and requirements can depend on the type of coverage someone has.

When you use health insurance for CPAP or for any other reason, you are responsible for several sets of costs.

Insurance plans have a deductible, which is the amount of money you must spend for covered services before your health insurance company pays for the rest. You are also responsible for copayments and coinsurance. These are amounts you may be required to pay for each medical service after you meet your deductible.

Additionally, a health insurance plan may feature an out-of-pocket maximum. This is the total yearly amount of money you have to pay from your own pocket before the health insurance company pays 100 percent for each service they cover.

In some cases, you may need to buy your CPAP machine outright in order for it to be covered by insurance. In other cases, insurance coverage applies if you rent it with regular monthly payments, generally for less than a year, after which you will own the machine. The amount of money you must spend out of pocket is usually the same in either case.

Reviewing your health plan and benefits will help you understand your coverage for any CPAP-related equipment or services. Your doctor or insurance provider may also be able to help you understand the coverage you have and the expenses you may face.

Medicare covers CPAP machines and essential supplies when an adult is diagnosed with moderate or severe obstructive sleep apnea. In addition to diagnosing sleep apnea, the person’s doctor must attest that if the person does not receive a CPAP machine, they will likely require surgery.

Medicare requires evidence that a prospective CPAP user has stopped breathing, or experienced apnea, at least 30 times during a six- to seven-hour period of sleep. Each apnea episode must last for at least 10 seconds.

After a doctor supplies this evidence, and after a person meets their deductible, Medicare covers 80% of CPAP machine rental and supply costs as long as the person consistently uses the machine for at least 90 days. After that three-month trial period, Medicare may extend their coverage of the CPAP device if the user goes to an in-person doctor’s appointment.

Following this appointment, the doctor must state that in the person’s medical records that they meet specific conditions and are receiving benefit from the CPAP therapy. The doctor must also state that the CPAP therapy is providing benefit to the patient.

People who have Medicare coverage should make sure their doctor and their medical equipment company are enrolled in Medicare. If they are not, Medicare will refuse to pay the claim. The Medicare website offers more information about health care providers, CPAP coverage, and where to get covered CPAP machines and supplies.

CPAP machines are prescription-only devices. A doctor will issue a prescription following an in-lab sleep study or an at-home sleep apnea test. This means a doctor must prescribe this treatment before you can obtain a CPAP machine and before an insurance provider or Medicare will cover the treatment.

People who do not use CPAP machines regularly or correctly will not receive the benefits of this therapy. For this reason, health insurance companies often require regular use of the CPAP in order to continue providing coverage.

Because CPAP machines effectively treat obstructive sleep apnea if they are used properly, doctors often provide guidelines for using CPAP devices successfully. Experts agree that a person using a CPAP machine should use it at least four hours each night for a minimum of five nights a week.

Unfortunately, some people fail to use the machine the way it is prescribed. In fact, as many as 40% of people with CPAP prescriptions do not use their devices. Others do not use their machines all night or every night.

For those who do not use their CPAP machines correctly, insurers may discontinue their coverage. Many insurance providers follow Medicare’s requirements for compliance. Medicare requires proven CPAP usage for four or more hours a night, at least seven out of every 10 nights over a period of 30 days.

Doctors can verify that someone is consistently and correctly using the CPAP device through a modem found in some machines. Other CPAP devices feature a memory card that stores usage information to be downloaded later.

It is important to use a CPAP machine according to a doctor’s instructions. People who are concerned about using a CPAP machine properly or consistently may consider renting a machine for several months before investing in their own machine. If you have questions about whether renting a machine is a good option for you, speak with your doctor.

If you experience issues using the device all night, speak with your doctor. Your doctor can provide education and troubleshooting to help you get the greatest benefit from your treatment.

If someone does not have health insurance, they will need to pay for their own CPAP equipment. CPAP machines can range in price from about $500 to as much as $3,000. This price does not include the cost of accessories such as masks and other CPAP equipment.

Even if someone has health care coverage, they may want to pay the full price themselves. This could be because of high deductibles and copayments, or because they want a wider selection of products to choose from. Furthermore, people who pay out of pocket do not have to adhere to compliance rules.

Keep in mind that, even if you are paying all the cost yourself, you can only obtain a CPAP machine with a doctor’s valid prescription.